Don’t Pass Up These Solar Tax Credit Savings

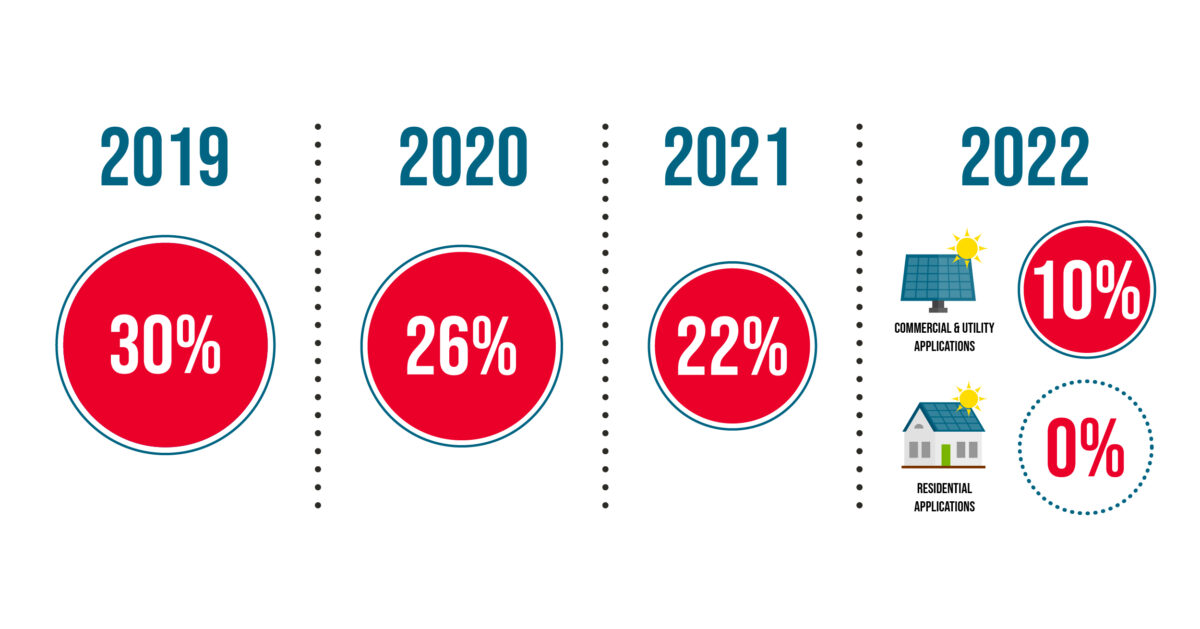

Don’t Pass Up These Solar Tax Credit Savings If you’ve been thinking of moving to solar energy to power your home, now is the right time to make that valuable investment. The Florida Solar Tax Credit is a substantial 26%. Now here’s the urgent part: This credit expires on December 31 of this year. And it will drop to 22% in 2021. Still not a bad deal, but why wait to lose 4% of savings when you can act now?

How Does the Solar Tax Credit Work?

After your solar energy system has been installed, you can apply for the Federal Solar Tax Credit. Once that credit has been applied, you’ll receive 26% of your total project costs (including equipment, permitting, and installation) as a credit on your federal tax return. So let’s say you owe $5,000 in federal taxes this year. If you claim a $3,000 tax credit, that pays off a huge chunk of your liability, and you would be left to pay just $2,000 in taxes after the credit is applied.

Do You Qualify for the Solar Tax Credit? – Yes You Do!

As long as you purchase your solar system by December 31, 2020, you’ll earn the full 26% Federal Solar Tax Credit. Other stipulations to keep in mind:

- You must own the single-family home that you want to outfit with solar power

- You must own the solar panels purchased for your home

Contact us now at Florida Solar as time is running out on this tax credit. Once the year is up, the savings credit will drop to 22%. Don’t miss out on this opportunity to save and get a system that greatly reduces your energy bill. The sooner you contact Florida Solar, the sooner we can get you on the path to long-term energy savings at a big discount over what you’re paying today to your electricity provider.

If you have any questions about solar power or would like more information on our services, email us today at sales@floridasolar.solar or call (727) 300-1515. Our experts are available to discuss different types of solar energy systems, the savings you can expect, and your financing options.